Canceling Progressive Insurance? Don’t Panic, We’ve Got You Covered. Progressive Insurance is one of the top names in the industry, but sometimes life throws curveballs, and you may need to cancel your policy. Whether it’s due to switching providers, selling your car, or simply reassessing your budget, knowing how to cancel Progressive Insurance properly can save you a ton of hassle. In this guide, we’ll walk you through every step so you can handle the process with ease.

Let’s be real here—insurance isn’t the most exciting topic, but it’s definitely important. When it comes to Progressive Insurance, canceling your policy might feel like a daunting task, but trust me, it doesn’t have to be. With the right steps and some insider tips, you’ll breeze through it faster than you can say “deductible.”

Now, before we dive into the nitty-gritty, let’s clear up a few things. Canceling Progressive Insurance doesn’t mean you’re doing something wrong or that you’re giving up on protection. Sometimes, it’s just about finding the best fit for your current situation. So, grab a coffee, sit back, and let’s tackle this together.

Read also:Dana Perinos Husband Health Struggles What You Need To Know

Why Would You Want to Cancel Progressive Insurance?

Life happens, and so do changes in your financial or personal circumstances. There are plenty of reasons why someone might decide to cancel their Progressive Insurance policy. Maybe you’ve found a better deal elsewhere, or perhaps you no longer need coverage. Whatever the reason, understanding the “why” can help you approach the process with confidence.

Here are a few common scenarios:

- You’ve decided to switch to another insurance provider for better rates or coverage.

- You’ve sold or stopped driving your car.

- You’re moving to a new location where Progressive isn’t available.

- You want to explore other options that better suit your budget or lifestyle.

Whatever your reason, Progressive makes it relatively easy to cancel your policy. Just be prepared to follow the proper steps to avoid any unnecessary fees or complications.

Steps to Cancel Progressive Insurance: A Simple Breakdown

Canceling Progressive Insurance isn’t rocket science, but it does require a little organization. Here’s a step-by-step guide to help you navigate the process smoothly:

Step 1: Review Your Policy

Before you make any moves, take a moment to review your policy details. This will give you a clearer picture of what you’re canceling and whether there are any cancellation fees involved. Look for important information like your policy number, coverage dates, and any penalties for early termination.

Step 2: Gather Necessary Information

Having all your ducks in a row is key to a stress-free cancellation process. Make sure you have the following handy:

Read also:Rj Davis Caleb Love The Rising Star In The World Of Basketball

- Your policy number.

- Your personal identification details, such as your driver’s license or social security number.

- A copy of your current policy documents.

Trust me, having everything ready will save you time and frustration later on.

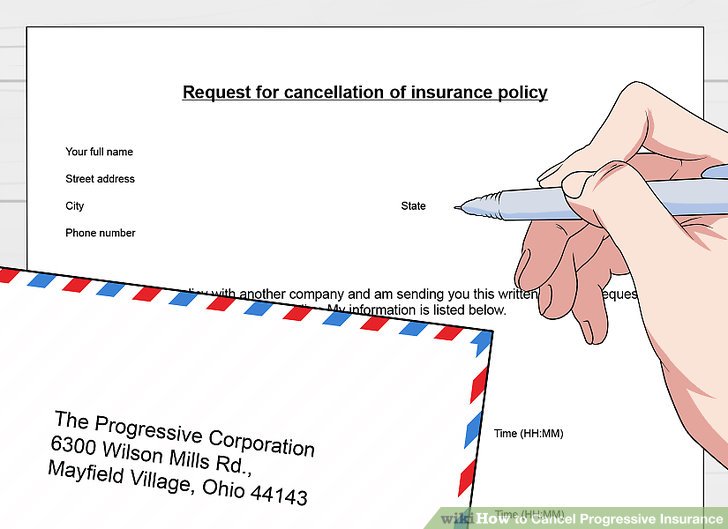

Step 3: Contact Progressive

Once you’re prepared, it’s time to reach out to Progressive. You can cancel your policy in a few different ways:

- Call Progressive’s customer service line at 1-800-PROGRESSIVE (1-800-776-4773).

- Visit your local Progressive agent’s office.

- Log in to your account on Progressive’s website and submit a cancellation request online.

No matter which method you choose, make sure to confirm the cancellation in writing. This will protect you in case there’s any confusion down the line.

What Happens After You Cancel Progressive Insurance?

Once you’ve officially canceled your Progressive Insurance policy, a few things will happen:

- You’ll receive a confirmation of cancellation, either via email or mail.

- If you’ve paid in advance for coverage that hasn’t been used yet, Progressive will issue a refund for the unused portion of your premium.

- Your coverage will officially end on the cancellation date you specified.

It’s crucial to ensure that your cancellation has been processed correctly. Follow up with Progressive if you don’t receive confirmation within a few days.

Common Questions About Canceling Progressive Insurance

Q: Can I Cancel Progressive Insurance Anytime?

Absolutey, yes! You can cancel your Progressive Insurance policy at any time, but there might be some conditions to consider. For instance, if you’re in the middle of a billing cycle, you might need to pay a prorated amount for the time you were covered.

Q: Is There a Fee for Canceling Progressive Insurance?

Not necessarily. While some insurance companies charge cancellation fees, Progressive doesn’t typically impose them. However, if you’ve signed up for a bundled package or special promotion, there might be terms that require you to pay a fee if you cancel early. Always check your policy documents to be sure.

Q: How Long Does It Take to Process a Cancellation?

Progressive is pretty efficient when it comes to processing cancellations. In most cases, you can expect your request to be finalized within a few business days. If you’re switching to a new provider, make sure to plan accordingly to avoid any gaps in coverage.

Understanding Progressive Insurance Cancellation Fees

While Progressive doesn’t usually charge cancellation fees, there are a few situations where you might incur additional costs. For example, if you’ve opted for a financing plan or if you’re canceling during a promotional period, there could be penalties. Always read the fine print of your policy to understand any potential fees.

Here’s a quick rundown of what to look out for:

- Early termination fees for bundled policies.

- Refunds for unused portions of your premium.

- Potential penalties for canceling during a promotional period.

It’s always a good idea to ask Progressive’s customer service team for clarification if you’re unsure about any fees.

Switching to Another Insurance Provider

If you’re canceling Progressive Insurance to switch to another provider, there are a few things to keep in mind. First, make sure your new policy is active before canceling your existing one. Gaps in coverage can leave you vulnerable in case of an accident or unexpected event.

Here are some tips to make the transition smoother:

- Compare quotes from multiple providers to find the best deal.

- Check the new provider’s reputation and customer reviews.

- Ensure your new policy offers the same or better coverage than your Progressive policy.

By doing your homework upfront, you’ll avoid any unpleasant surprises later on.

Cancel Progressive Insurance Online: Is It Possible?

Absolutely! Progressive offers an easy online option for canceling your policy. All you need to do is log in to your account on their website, navigate to the cancellation section, and follow the prompts. It’s quick, convenient, and hassle-free.

Here’s a step-by-step guide to canceling Progressive Insurance online:

- Go to the Progressive website and log in to your account.

- Locate the “Manage My Policy” section.

- Select the option to cancel your policy.

- Follow the instructions to confirm your cancellation date.

- Print or save the confirmation for your records.

Easy peasy, right?

Tips to Avoid Common Mistakes When Canceling Progressive Insurance

Canceling Progressive Insurance might seem straightforward, but there are a few common mistakes that people make. Here’s how to avoid them:

- Don’t forget to confirm your cancellation in writing.

- Double-check the cancellation date to ensure there are no gaps in coverage.

- Make sure you understand any potential fees or penalties before proceeding.

- Keep a record of all communications with Progressive, including emails and phone calls.

By staying organized and informed, you’ll breeze through the cancellation process without any hiccups.

Alternatives to Canceling Progressive Insurance

Before you cancel your Progressive Insurance policy, consider whether there are other options that might work better for you. For example, you could:

- Adjust your coverage limits to better fit your needs.

- Bundle multiple policies with Progressive for a discount.

- Review your deductible and premium options to find a more affordable plan.

Sometimes, making small adjustments to your existing policy can save you money without the hassle of switching providers.

Conclusion: Wrapping It Up

Canceling Progressive Insurance doesn’t have to be a headache if you approach it with the right mindset and tools. By following the steps outlined in this guide, you’ll be able to cancel your policy smoothly and efficiently. Remember to review your policy details, gather all necessary information, and confirm your cancellation in writing.

So, whether you’re switching providers, selling your car, or reassessing your budget, you’ve got this. And hey, don’t forget to share this guide with anyone else who might find it helpful. Let’s spread the knowledge and make canceling Progressive Insurance a breeze for everyone!

Table of Contents

- Why Would You Want to Cancel Progressive Insurance?

- Steps to Cancel Progressive Insurance: A Simple Breakdown

- What Happens After You Cancel Progressive Insurance?

- Common Questions About Canceling Progressive Insurance

- Understanding Progressive Insurance Cancellation Fees

- Switching to Another Insurance Provider

- Cancel Progressive Insurance Online: Is It Possible?

- Tips to Avoid Common Mistakes When Canceling Progressive Insurance

- Alternatives to Canceling Progressive Insurance

- Conclusion: Wrapping It Up