So, you've probably heard about the NYTimes Rent vs Buy Calculator, right? It's like this super cool tool that helps you figure out whether renting or buying a home is the better financial move for you. If you're sitting there scratching your head trying to decide which path to take, this calculator is like your financial GPS. Let’s dive into why it's such a game-changer and how it can save you from making some serious money mistakes.

Buying a house sounds awesome, right? But hold up—what if renting is actually the smarter option for your situation? That’s where the NYTimes Rent vs Buy Calculator comes in. It’s not just some random online tool; it’s a legit, data-driven way to help you weigh the pros and cons of both options. Trust me, it’s worth checking out before you make any big decisions.

Whether you're fresh out of college, in the middle of your career, or thinking about retirement, this calculator can give you some much-needed clarity. It's like having a financial advisor in your pocket, except it’s free and way less intimidating. Let’s break down everything you need to know so you can make the best choice for your future.

Read also:Did Rick Lagina Passed Away Unveiling The Truth Behind The Legend

Why the NYTimes Rent vs Buy Calculator Matters

Let’s face it—buying a home is one of the biggest financial decisions you’ll ever make. But with rising housing costs, fluctuating interest rates, and the uncertainty of the market, it’s not exactly a no-brainer. That’s why the NYTimes Rent vs Buy Calculator is such a big deal. It takes all those confusing factors and simplifies them into an easy-to-use tool that gives you real answers.

This calculator doesn’t just spit out a random number—it considers things like property taxes, maintenance costs, mortgage rates, and even inflation. It’s like a financial crystal ball that shows you the long-term implications of your decision. And hey, who doesn’t want to know if they’re throwing money away or building equity?

How Does the NYTimes Rent vs Buy Calculator Work?

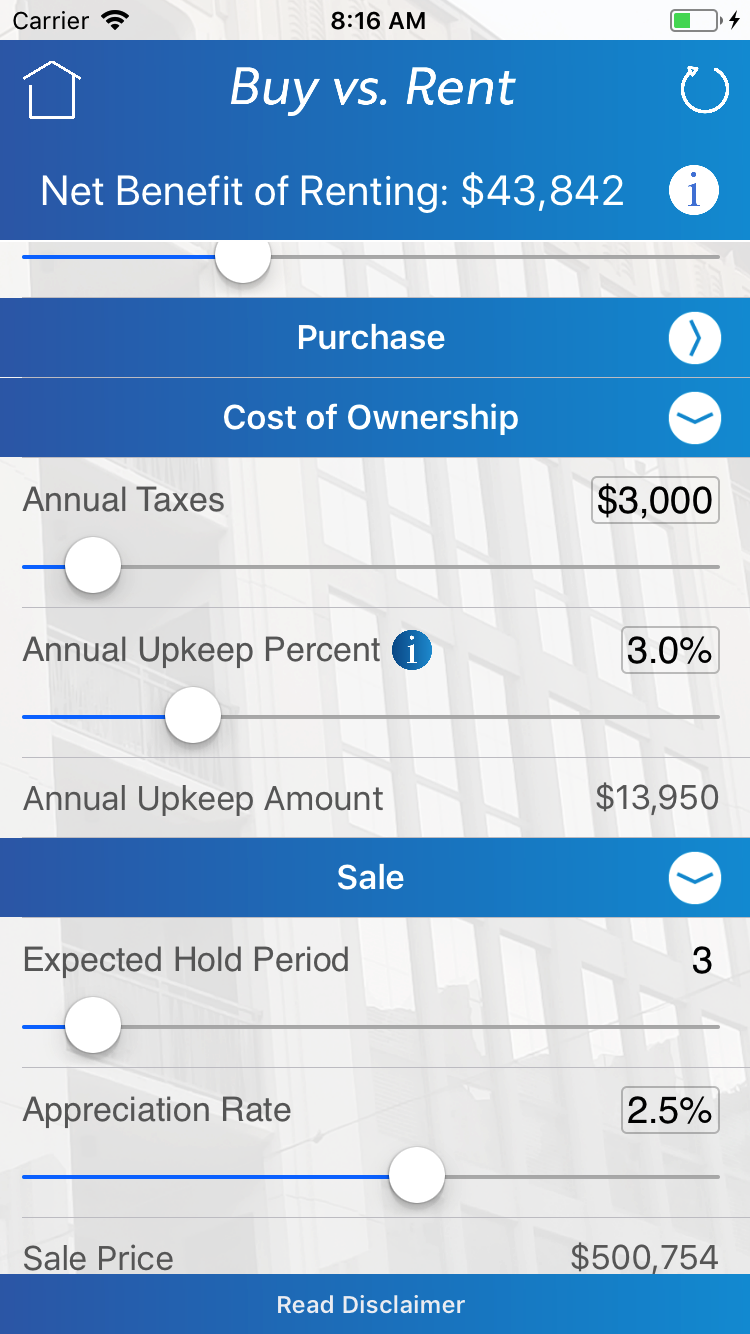

Alright, here’s the deal: the calculator works by comparing the total costs of renting versus buying over a specific time period. You input details like the price of the home you’re considering, your expected rent, how long you plan to stay in the area, and other financial details. Then, it crunches the numbers and tells you which option makes more sense for you.

But wait, there’s more! It also accounts for things like tax benefits, down payments, and opportunity costs. So, if you’re thinking about buying a house, it’ll show you how much you’d need to save upfront and whether that money could be better spent elsewhere. Pretty neat, right?

Key Features of the Calculator

Here’s a quick rundown of what makes the NYTimes Rent vs Buy Calculator so powerful:

- Customizable inputs for your unique situation

- Comprehensive cost breakdowns for both renting and buying

- Consideration of long-term financial implications

- Realistic assumptions based on current market data

- Easy-to-understand results that guide your decision-making

It’s not just about the numbers—it’s about giving you the confidence to make a smart choice. Whether you’re a first-time homebuyer or a seasoned renter, this calculator has your back.

Read also:Dana Perino Husband Diagnosis The Journey Beyond The Headlines

Understanding the Financial Implications

When you’re weighing the rent vs buy decision, there are a ton of factors to consider. The NYTimes Rent vs Buy Calculator helps you break it all down so you can see the big picture. For example, did you know that buying a home isn’t just about the monthly mortgage payment? There are also property taxes, insurance, maintenance, and repairs to think about.

On the flip side, renting might seem simpler, but it comes with its own set of costs. Your rent could increase over time, and you’re not building any equity. Plus, there’s always the risk of losing your rental property if the landlord decides to sell. The calculator helps you weigh all these factors so you can make an informed decision.

Long-Term vs Short-Term Thinking

One of the coolest things about the NYTimes Rent vs Buy Calculator is that it encourages you to think long-term. Sure, renting might seem cheaper right now, but what about five or ten years down the road? The calculator shows you how those costs can add up over time and whether buying a home could be a better investment in the long run.

And let’s not forget about inflation. Over time, the cost of renting is likely to increase, while your mortgage payment stays the same (assuming you have a fixed-rate loan). The calculator takes all these variables into account, giving you a more accurate picture of your financial future.

Common Misconceptions About Renting vs Buying

There are a lot of myths floating around about renting versus buying, and the NYTimes Rent vs Buy Calculator helps bust some of them. For example, many people assume that buying a home is always the better choice because you’re building equity. But that’s not always true. Depending on your situation, renting might actually be the smarter option.

Another misconception is that buying a home is a guaranteed investment. While real estate can appreciate in value, it’s not a sure thing. Markets can fluctuate, and there’s always the risk of a housing bubble bursting. The calculator helps you weigh these risks and make a more balanced decision.

Breaking Down the Myths

Here are a few common myths about renting vs buying and why they might not apply to your situation:

- Myth 1: Buying is always better than renting. Reality: It depends on how long you plan to stay in the area and whether you can afford the upfront costs.

- Myth 2: Renting is throwing money away. Reality: Renting gives you flexibility and can be a better option if you don’t want to tie up your money in a home.

- Myth 3: Homeownership is a guaranteed investment. Reality: Real estate markets can be unpredictable, and there’s no guarantee your home will appreciate in value.

The NYTimes Rent vs Buy Calculator helps you separate fact from fiction so you can make the best decision for your financial situation.

Who Should Use the NYTimes Rent vs Buy Calculator?

This calculator isn’t just for first-time homebuyers. It’s for anyone who’s trying to decide whether renting or buying is the better option. Whether you’re a young professional, a growing family, or a retiree, this tool can help you evaluate your options and make a smart financial decision.

Here are a few scenarios where the calculator can come in handy:

- You’re moving to a new city and trying to decide whether to rent or buy.

- You’re considering refinancing your mortgage or selling your current home.

- You want to understand the long-term financial implications of your housing choices.

No matter where you are in life, the NYTimes Rent vs Buy Calculator can give you the clarity you need to make the right choice.

Customizing the Calculator for Your Situation

One of the best things about the calculator is that it’s fully customizable. You can adjust the inputs to reflect your unique situation, whether you’re buying a small apartment in the city or a sprawling house in the suburbs. And if you’re not sure about some of the numbers, don’t worry—the calculator provides reasonable defaults to get you started.

So, whether you’re a tech-savvy millennial or a baby boomer looking to downsize, the calculator can help you make sense of the numbers and find the best option for your lifestyle.

How to Use the NYTimes Rent vs Buy Calculator Effectively

Ready to give it a try? Here’s how to use the NYTimes Rent vs Buy Calculator to get the most accurate results:

- Start by entering the price of the home you’re considering.

- Add in your expected rent and how long you plan to stay in the area.

- Input details like down payment, mortgage rate, property taxes, and maintenance costs.

- Review the results and see which option makes more financial sense for you.

Remember, the calculator is just a tool—it’s not a substitute for professional financial advice. But it can give you a solid starting point for making an informed decision.

Tips for Getting the Most Out of the Calculator

Here are a few tips to help you get the most out of the NYTimes Rent vs Buy Calculator:

- Be realistic about your numbers. Don’t underestimate costs like maintenance or overestimate how much you can afford.

- Consider both short-term and long-term scenarios. The calculator can show you how your decision might look in five, ten, or even twenty years.

- Use it as a guide, not a final answer. The calculator can help you weigh the pros and cons, but ultimately, the decision is yours.

By following these tips, you’ll be able to make a more confident and informed decision about your housing future.

Real-Life Examples: Success Stories

To give you a better idea of how the NYTimes Rent vs Buy Calculator works in real life, let’s look at a few success stories:

Example 1: Sarah was considering buying a condo in the city but wasn’t sure if it was the right move. After using the calculator, she realized that renting for a few more years would give her the flexibility she needed without tying up all her savings.

Example 2: John and his wife were thinking about buying a house in the suburbs. The calculator showed them that buying would actually save them money in the long run, thanks to lower property taxes and a fixed mortgage rate.

These real-life examples show how the calculator can help people make smarter financial decisions based on their unique situations.

Lessons Learned from Real Users

Here are a few key takeaways from users who’ve used the NYTimes Rent vs Buy Calculator:

- Flexibility is key. If you’re not sure where you’ll be in a few years, renting might be the better option.

- Location matters. Housing costs can vary drastically depending on where you live, so it’s important to factor that into your decision.

- Long-term planning pays off. By considering the long-term implications of your decision, you can avoid costly mistakes down the road.

These lessons can help you make a more informed decision and avoid common pitfalls.

Conclusion: Making the Right Choice for Your Future

So, there you have it—the ultimate guide to using the NYTimes Rent vs Buy Calculator. Whether you’re a first-time homebuyer or a seasoned renter, this tool can help you make a smarter financial decision. By weighing the costs and benefits of both options, you can find the best solution for your lifestyle and financial goals.

Remember, there’s no one-size-fits-all answer when it comes to renting versus buying. Your decision should be based on your unique situation, including your budget, timeline, and personal preferences. The NYTimes Rent vs Buy Calculator is here to help you navigate those complexities and make the best choice for your future.

Now that you know how to use the calculator effectively, it’s time to take action. Try it out for yourself and see which option makes the most sense for you. And don’t forget to share your experience in the comments below—we’d love to hear how the calculator helped you make your decision!

Table of Contents

- Why the NYTimes Rent vs Buy Calculator Matters

- How Does the NYTimes Rent vs Buy Calculator Work?

- Key Features of the Calculator

- Understanding the Financial Implications

- Long-Term vs Short-Term Thinking

- Common Misconceptions About Renting vs Buying

- Breaking Down the Myths

- Who Should Use the NYTimes Rent vs Buy Calculator?

- Customizing the Calculator for Your Situation

- How to Use the NYTimes Rent vs Buy Calculator Effectively

- Tips for Getting the Most Out of the Calculator

- Real-Life Examples: Success Stories

- Lessons Learned from Real Users