So here's the deal, folks. Renting or buying a home is one of the biggest financial decisions you'll ever make, and let's be honest, it ain't easy. The New York Times Rent vs Buy calculator has been making waves as a go-to resource for people trying to figure out what's best for their wallet. Whether you're a first-time homebuyer or just tired of paying rent, this guide will break it all down for you in a way that even your grandma could understand. Trust me, you're gonna wanna hear this.

Now, I know what you're thinking. "Why should I care about the New York Times Rent vs Buy calculator?" Well, my friend, it's not just about numbers. It's about your future, your dreams, and your bank account. This isn't some random article you stumble upon; it's a deep dive into the nitty-gritty details that could save you thousands—or maybe even hundreds of thousands—of dollars. So buckle up, because we're about to get real.

And before we go any further, let's set the record straight. This isn't just another clickbait article. We're diving into the heart of the matter, exploring the ins and outs of renting versus buying with the help of the NYTimes Rent vs Buy calculator. So whether you're in New York City, Los Angeles, or even a small town, this guide is for you. Let's get started, shall we?

Read also:Dean Winters Married The Untold Love Story Of A Hollywood Veteran

The Basics of Rent vs Buy

Alright, let's start with the basics. Renting and buying are two completely different beasts. Renting means you're paying someone else for the privilege of living in their space, while buying means you're building equity and owning a piece of the American dream. But here's the thing—it's not as simple as it sounds. The NYTimes Rent vs Buy calculator helps you weigh the pros and cons, but let's break it down a little further.

When you rent, you're essentially paying for convenience. No property taxes, no maintenance headaches, and no worrying about the housing market. But on the flip side, every dollar you spend on rent is money you'll never get back. Buying, on the other hand, can be a great investment if you play your cards right. But it also comes with its own set of challenges, like down payments, mortgage rates, and market fluctuations.

Why the NYTimes Rent vs Buy Calculator Matters

So why should you care about the NYTimes Rent vs Buy calculator? Well, it's not just some random tool. It's a powerful resource that takes into account all the factors that matter—things like location, interest rates, property taxes, and even inflation. It's like having a financial advisor in your pocket, but without the hefty price tag.

Here's the kicker: the calculator doesn't just spit out a number. It gives you a detailed breakdown of what you're really paying for when you rent versus buy. And let's be honest, that's something we could all use a little more clarity on. So whether you're trying to decide if now's the right time to buy or if renting is still the better option, this calculator has got your back.

Breaking Down the Numbers

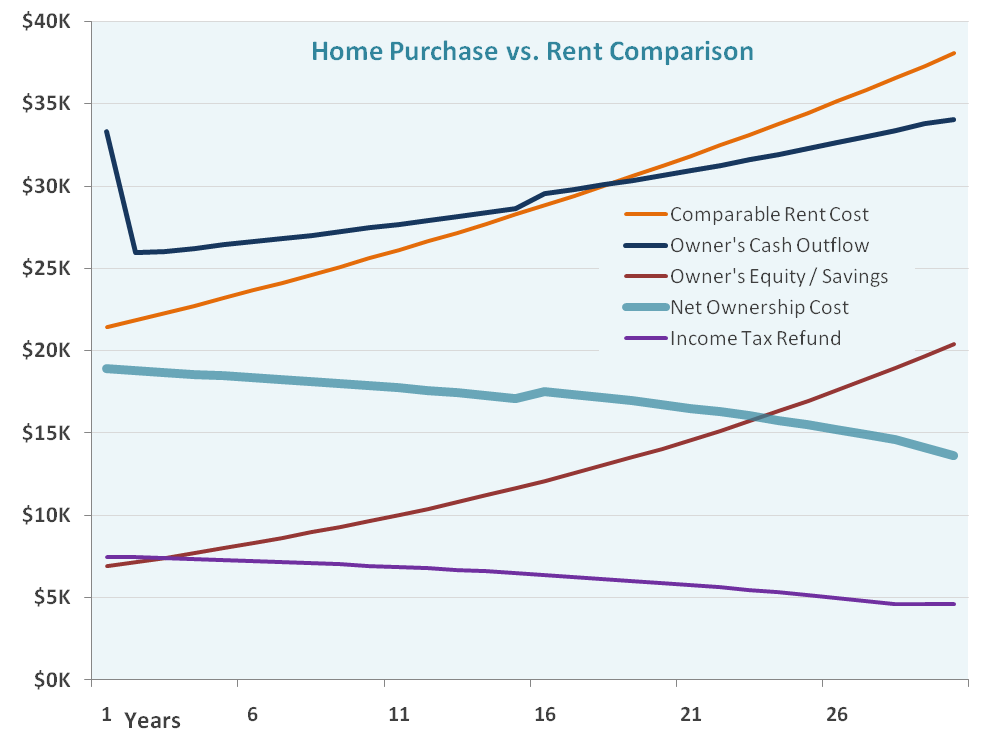

Now, let's talk numbers. The NYTimes Rent vs Buy calculator is all about crunching the numbers to give you a clear picture of what you're getting into. Here's a quick rundown of the factors it considers:

- Down payment: How much you need to put down upfront

- Mortgage rate: The interest rate on your home loan

- Property taxes: The annual cost of owning a home

- Home appreciation: How much your home's value is expected to increase

- Maintenance costs: The ongoing expenses of owning a home

- Rent prices: How much you'd be paying if you chose to rent instead

These are just a few of the factors that go into the calculator, but they're some of the most important ones. And the beauty of it is, you can adjust these numbers to fit your own situation. So whether you're in a hot market like San Francisco or a more affordable area like Detroit, the calculator can help you make sense of it all.

Read also:Dana Perinos Husband Health Struggles What You Need To Know

Understanding the Financial Impact

Now, let's dive a little deeper into the financial impact of renting versus buying. When you rent, you're essentially paying for the privilege of living in someone else's property. And while that might sound like a no-brainer, it's important to understand the long-term implications. For example, if you're paying $2,000 a month in rent, that's $24,000 a year that you're not putting toward building equity.

On the other hand, buying a home can be a great investment if you play your cards right. But it's not without its risks. For example, if you buy a home and the housing market crashes, you could end up underwater on your mortgage. That's why it's so important to use tools like the NYTimes Rent vs Buy calculator to weigh the pros and cons before making a decision.

Location, Location, Location

Let's talk about location. As they say in real estate, location is everything. And when it comes to renting versus buying, it can make a huge difference. For example, if you're living in a city like New York or San Francisco, where rents are sky-high, buying might actually be the more affordable option in the long run. But if you're in a more affordable area, renting might make more sense.

The NYTimes Rent vs Buy calculator takes location into account by allowing you to input the cost of rent and home prices in your area. This gives you a much clearer picture of what you're really paying for when you rent versus buy. And let's be honest, that's something we could all use a little more clarity on.

Urban vs Suburban Living

Now, let's talk about urban versus suburban living. If you're living in a city, chances are you're paying a premium for convenience. But if you're in the suburbs, you might be getting more bang for your buck. The NYTimes Rent vs Buy calculator can help you weigh the pros and cons of living in different areas, taking into account factors like commute times, property taxes, and school districts.

And let's not forget about lifestyle. If you're someone who loves the hustle and bustle of city life, renting might be the better option. But if you're looking for more space and a quieter lifestyle, buying a home in the suburbs might be the way to go. It's all about finding the right balance for your lifestyle and financial goals.

Market Trends and Forecasting

Now, let's talk about market trends and forecasting. The housing market is constantly changing, and it's important to stay informed if you're considering buying a home. The NYTimes Rent vs Buy calculator takes into account factors like home appreciation and inflation, giving you a clearer picture of what the future might hold.

But here's the thing: no one can predict the future with 100% accuracy. That's why it's so important to use tools like the calculator to make informed decisions. By taking into account historical data and current market trends, you can make a more educated guess about what the future might hold for the housing market.

Long-Term vs Short-Term Thinking

Now, let's talk about long-term versus short-term thinking. If you're planning to stay in one place for a long time, buying a home might be the better option. But if you're someone who likes to move around or isn't sure where you'll be in a few years, renting might be the way to go.

The NYTimes Rent vs Buy calculator helps you weigh these factors by allowing you to input how long you plan to stay in your home. This gives you a clearer picture of what you're really paying for when you rent versus buy. And let's be honest, that's something we could all use a little more clarity on.

Financial Planning and Budgeting

Now, let's talk about financial planning and budgeting. Whether you're renting or buying, it's important to have a solid financial plan in place. The NYTimes Rent vs Buy calculator can help you figure out how much you can afford to spend on housing, taking into account factors like your income, debt, and savings.

But here's the thing: budgeting isn't just about numbers. It's about making sure you're living within your means and setting yourself up for financial success in the long run. And that's something we could all use a little help with.

Building Equity vs Liquidity

Now, let's talk about building equity versus liquidity. When you buy a home, you're building equity over time. But when you rent, you're essentially paying for someone else's equity. And while that might sound like a no-brainer, it's important to understand the trade-offs.

For example, if you're someone who likes to have liquid assets, renting might be the better option. But if you're looking to build long-term wealth, buying a home could be the way to go. The NYTimes Rent vs Buy calculator can help you weigh these factors and make a more informed decision.

Conclusion

So there you have it, folks. Renting versus buying is one of the biggest financial decisions you'll ever make, and the NYTimes Rent vs Buy calculator is here to help you make sense of it all. Whether you're in a big city or a small town, this tool can help you weigh the pros and cons and make a more informed decision.

But here's the thing: it's not just about numbers. It's about your lifestyle, your financial goals, and your dreams for the future. So take the time to think it through, use the calculator, and make the best decision for you and your family.

And if you've found this article helpful, don't forget to share it with your friends and family. And if you have any questions or comments, feel free to leave them below. We'd love to hear from you!

Table of Contents

- The Basics of Rent vs Buy

- Why the NYTimes Rent vs Buy Calculator Matters

- Breaking Down the Numbers

- Understanding the Financial Impact

- Location, Location, Location

- Urban vs Suburban Living

- Market Trends and Forecasting

- Long-Term vs Short-Term Thinking

- Financial Planning and Budgeting

- Building Equity vs Liquidity