Let’s face it, folks – the world of investing can feel like a maze. But today, we’re diving deep into one of the most talked-about platforms in the fintech space: Fintechzoom.com. If you’re curious about ETFs, Vanguard’s market presence, and how all of this ties together, you’ve come to the right place. Whether you’re a seasoned investor or just dipping your toes into the world of finance, this article’s got you covered.

Now, before we get too fancy, let’s break it down. Fintechzoom.com isn’t just another website; it’s a hub for financial enthusiasts who want to make smarter decisions. By connecting users with key players like Vanguard, it opens the door to a whole new level of investment opportunities. So, if you’re ready to level up your portfolio, grab a coffee, and let’s dive in!

Investing doesn’t have to be complicated. With the rise of ETFs (Exchange-Traded Funds) and market giants like Vanguard, the game has changed. Fintechzoom.com plays a crucial role in simplifying these complex concepts, making them accessible to everyone. Stick around, because by the end of this, you’ll feel like a pro!

Read also:Who Killed Mike Delfino Unraveling The Mystery Behind One Of Desperate Housewives Most Shocking Moments

What is Fintechzoom Com All About?

Fintechzoom.com isn’t your average financial platform. It’s designed to be your go-to resource for everything related to ETFs, mutual funds, and market trends. The platform’s mission? To empower investors by providing them with the tools and knowledge they need to thrive in today’s fast-paced financial world.

But what makes Fintechzoom stand out? For starters, its user-friendly interface. Whether you’re looking for real-time market updates or detailed analysis of ETFs, you’ll find everything in one place. And hey, who doesn’t love convenience, right?

Why Choose Fintechzoom Over Other Platforms?

Let’s talk numbers for a sec. According to recent studies, more than 70% of investors prefer platforms that offer comprehensive insights and easy navigation. Fintechzoom checks all the boxes. Here’s why:

- Comprehensive ETF Analysis: Get detailed breakdowns of top-performing ETFs.

- Real-Time Market Updates: Stay ahead of the curve with live market data.

- User-Friendly Interface: No complicated jargon here – just straightforward info.

- Expert Insights: Access expert opinions and market forecasts to guide your decisions.

So, if you’re tired of sifting through endless spreadsheets and confusing graphs, Fintechzoom might just be your new best friend.

Understanding ETFs: The Basics

Before we dive into the nitty-gritty, let’s cover the basics. ETFs, or Exchange-Traded Funds, are investment funds traded on stock exchanges. Think of them as baskets of securities that allow you to diversify your portfolio without having to buy individual stocks.

Now, here’s the cool part – ETFs are incredibly flexible. You can trade them like stocks, and they often come with lower fees compared to traditional mutual funds. It’s no wonder they’ve become so popular among investors of all levels.

Read also:Meet Marcello Hernandezs Parents The Heartwarming Story Behind The Scenes

Key Benefits of ETFs

Still not convinced? Check out these key benefits:

- Diversification: Spread your risk across multiple assets.

- Lower Costs: ETFs typically have lower expense ratios than mutual funds.

- Flexibility: Trade ETFs throughout the day, just like stocks.

- Transparency: Know exactly what you’re investing in with daily portfolio disclosures.

And let’s not forget – ETFs are perfect for both long-term and short-term strategies. Whether you’re playing the game for retirement or quick gains, there’s an ETF for that.

Vanguard ETFs: A Market Leader

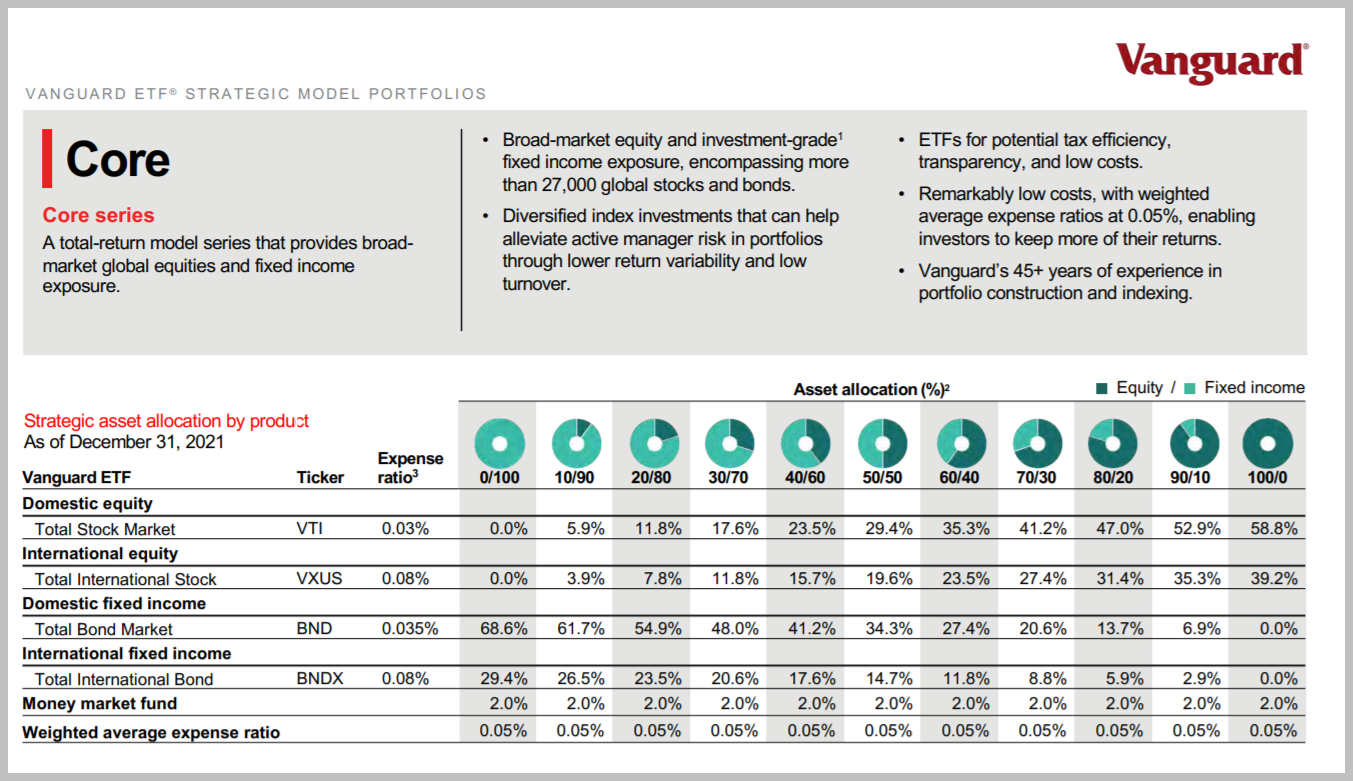

When it comes to ETFs, Vanguard is a name you can’t ignore. As one of the largest investment management companies in the world, Vanguard has been at the forefront of the ETF revolution. Their commitment to low-cost, high-quality funds has made them a favorite among investors.

But what sets Vanguard apart? Let’s break it down:

Why Vanguard ETFs Stand Out

Vanguard ETFs are known for their:

- Low Expense Ratios: Some of the lowest fees in the industry.

- Wide Range of Options: From broad-market ETFs to niche offerings.

- Strong Track Record: Vanguard has consistently delivered solid returns.

- Investor-Friendly Policies: No hidden fees and transparent pricing.

Plus, with Vanguard’s innovative approach to indexing, you can be confident that your investments are in good hands.

How Fintechzoom Com Bridges the Gap

Now that we’ve covered the basics of ETFs and Vanguard, let’s talk about how Fintechzoom.com fits into the picture. Think of Fintechzoom as the bridge that connects investors with the tools they need to succeed. Whether you’re looking for Vanguard ETFs or exploring other investment opportunities, Fintechzoom has got you covered.

Here’s how it works:

- Access to real-time data on Vanguard ETFs.

- Expert analysis to help you make informed decisions.

- Comparison tools to evaluate different ETF options.

- News and updates to keep you in the loop.

By leveraging Fintechzoom’s resources, you can streamline your investment process and focus on what truly matters – growing your wealth.

ETF Market Trends: What’s Hot Right Now?

Okay, let’s talk trends. The ETF market is constantly evolving, and staying informed is key. According to recent data, here are some of the hottest ETF trends:

- Sustainability: ESG (Environmental, Social, and Governance) ETFs are gaining traction as investors prioritize ethical investments.

- Technology: Tech-focused ETFs continue to dominate, driven by advancements in AI and blockchain.

- Healthcare: With the global focus on healthcare innovation, biotech ETFs are on the rise.

- International Markets: Investors are increasingly looking beyond borders for growth opportunities.

And guess what? Fintechzoom.com keeps you updated on all these trends, so you’re always one step ahead.

How Vanguard Fits Into These Trends

Vanguard has been quick to adapt to these changing trends. With a wide range of ETFs catering to different sectors and industries, they’ve positioned themselves as a leader in the space. Whether you’re interested in ESG investing or exploring international markets, Vanguard has something for everyone.

Common Misconceptions About ETFs

Let’s clear the air, shall we? There are a few common misconceptions about ETFs that we need to address:

- ETFs Are Only for Experts: Wrong! ETFs are designed for investors of all levels.

- ETFs Are Risky: Like any investment, there are risks involved, but diversification helps mitigate them.

- ETFs Are Only for Long-Term Investors: Nope! ETFs can be used for both long-term and short-term strategies.

By understanding these misconceptions, you can make more informed decisions about your investments.

How to Get Started with ETF Investing

Ready to jump in? Here’s a quick guide to getting started with ETF investing:

- Set Your Goals: Determine what you want to achieve with your investments.

- Do Your Research: Use platforms like Fintechzoom to explore your options.

- Open an Account: Choose a brokerage that offers ETFs, like Vanguard.

- Start Small: Begin with a small investment to get a feel for the market.

- Monitor and Adjust: Keep an eye on your portfolio and make adjustments as needed.

Remember, investing is a journey, not a sprint. Take your time and learn as you go.

Expert Tips for ETF Success

Want to take your ETF investing to the next level? Here are some expert tips:

- Diversify Your Portfolio: Spread your investments across different sectors and asset classes.

- Stay Informed: Keep up with market trends and news to make timely decisions.

- Reinvest Dividends: Compound your returns by reinvesting dividends.

- Be Patient: The market can be volatile, but long-term investing pays off.

By following these tips, you’ll be well on your way to ETF success.

How Fintechzoom Can Help You Succeed

Fintechzoom.com is more than just a platform – it’s a partner in your investment journey. With its wealth of resources and expert insights, you’ll have everything you need to thrive in the ETF market.

Conclusion: Take the Leap

There you have it, folks – your ultimate guide to Fintechzoom.com, ETFs, and Vanguard. Investing doesn’t have to be daunting, and with the right tools and knowledge, you can make smarter decisions. Whether you’re exploring ETFs for the first time or looking to expand your portfolio, Fintechzoom has got your back.

So, what are you waiting for? Take the leap and start your investment journey today. And don’t forget to share this article with your friends – knowledge is power!

Table of Contents

What is Fintechzoom Com All About?

Understanding ETFs: The Basics

Vanguard ETFs: A Market Leader

How Fintechzoom Com Bridges the Gap

ETF Market Trends: What’s Hot Right Now?

Common Misconceptions About ETFs

How to Get Started with ETF Investing