So here's the deal, if you're diving into the world of personal finance or wealth management, the term allied integrated wealth financial advisor might have popped up on your radar. Think of it like a Swiss Army knife for your money matters—these advisors aren’t just here to manage your investments; they're here to craft a holistic financial strategy tailored just for you. This isn’t your grandpa’s financial advice; it’s cutting-edge, personalized, and designed to help you reach your financial goals faster than you can say "retirement fund."

In today’s fast-paced world, where markets can change in the blink of an eye, having a trusted advisor by your side can make all the difference. But not all advisors are created equal. That’s why understanding what an allied integrated wealth financial advisor brings to the table is crucial. Think of them as your personal financial sherpa, guiding you through the mountains of financial jargon and helping you navigate the rocky terrain of investment opportunities.

Now, before we dive deep into the nitty-gritty, let me ask you this: Do you ever feel like you're flying blind when it comes to managing your money? If you're nodding your head right now, then buckle up because we’re about to uncover the secrets behind these financial wizards. By the end of this, you'll have a clearer picture of what makes an allied integrated wealth financial advisor different from the rest and why they might be the missing piece in your financial puzzle.

Read also:How Old Was Gypsy Rose Boyfriend Unveiling The Truth Behind The Drama

What Exactly is Allied Integrated Wealth Financial Advisor?

Alright, let’s get down to business. An allied integrated wealth financial advisor isn’t just someone who crunches numbers all day. These professionals take a holistic approach to managing your finances. It’s like they’re not just looking at the trees but also seeing the entire forest. They analyze your income, expenses, investments, taxes, and even your retirement plans to create a comprehensive financial roadmap.

What sets them apart is their ability to integrate various aspects of your financial life into one cohesive strategy. It’s not just about picking the right stocks or bonds; it’s about understanding your long-term goals and aligning your financial decisions with them. Whether you're planning for your kid’s college fund or dreaming about that dream vacation home, these advisors help turn those dreams into realities.

Why Choose Allied Integrated Wealth Financial Advisor?

Let’s face it, when it comes to managing your money, trust is everything. So why should you choose an allied integrated wealth financial advisor? For starters, they bring a wealth of experience to the table. These advisors are not rookies; they’ve been in the trenches, seen the ups and downs of the market, and have the scars—and the wisdom—to prove it.

Moreover, they offer personalized service. Forget about one-size-fits-all solutions. These advisors take the time to understand your unique financial situation and tailor their advice accordingly. They’re like personal trainers for your finances, pushing you to reach your goals while keeping you from making costly mistakes.

Key Services Offered by Allied Integrated Wealth Financial Advisors

Now that we know what they are and why they’re important, let’s talk about what they actually do. An allied integrated wealth financial advisor offers a wide range of services designed to cover all aspects of your financial life. Here’s a quick rundown:

- Investment Management: Helping you build and manage a diversified investment portfolio.

- Retirement Planning: Ensuring you have a solid plan in place for your golden years.

- Tax Planning: Minimizing your tax liabilities while maximizing your returns.

- Estate Planning: Protecting your assets and ensuring they’re passed on to your loved ones.

- Insurance Solutions: Providing coverage to safeguard against unforeseen events.

These services aren’t just checkboxes; they’re the building blocks of a strong financial foundation. Think of them as the ingredients in a recipe—each one plays a crucial role in creating a delicious financial pie.

Read also:Christ On A Bike Meaning The Surprising Origins And Cultural Impact

How Allied Integrated Wealth Financial Advisors Work

So, how do these advisors work their magic? It all starts with a deep dive into your financial situation. They’ll ask questions about your income, expenses, assets, and liabilities. They’ll want to know about your short-term and long-term goals. And yes, they’ll probably ask about your risk tolerance too. It’s like they’re building a financial profile of you.

Once they have a clear picture, they’ll start crafting a strategy. This might involve reallocating your investments, adjusting your retirement contributions, or even restructuring your debt. It’s a collaborative process, and they’ll keep you in the loop every step of the way.

Benefits of Working with Allied Integrated Wealth Financial Advisors

So, what’s in it for you? Plenty! Here are some of the top benefits of working with an allied integrated wealth financial advisor:

- Peace of Mind: Knowing that your finances are in good hands can be a huge relief.

- Expert Guidance: These advisors have the knowledge and experience to guide you through even the toughest financial situations.

- Customized Solutions: Forget about generic advice; you’ll get strategies tailored specifically for you.

- Time Savings: Let’s face it, managing your finances can be time-consuming. These advisors take that burden off your shoulders.

And let’s not forget the big one—financial growth. With the right advice and strategy, you can grow your wealth faster and more efficiently than if you were going it alone.

Costs and Fees

Alright, let’s talk turkey. How much does it cost to work with an allied integrated wealth financial advisor? Fees can vary widely depending on the advisor and the services you need. Some charge a flat fee, others take a percentage of your assets under management. It’s important to have a clear understanding of the costs upfront so there are no surprises down the road.

But here’s the thing—think of it as an investment. Just like you’d pay a mechanic to fix your car or a doctor to take care of your health, paying a financial advisor is an investment in your financial well-being. And trust me, it’s worth it.

Choosing the Right Allied Integrated Wealth Financial Advisor

Not all allied integrated wealth financial advisors are created equal, so how do you choose the right one? Here are a few tips:

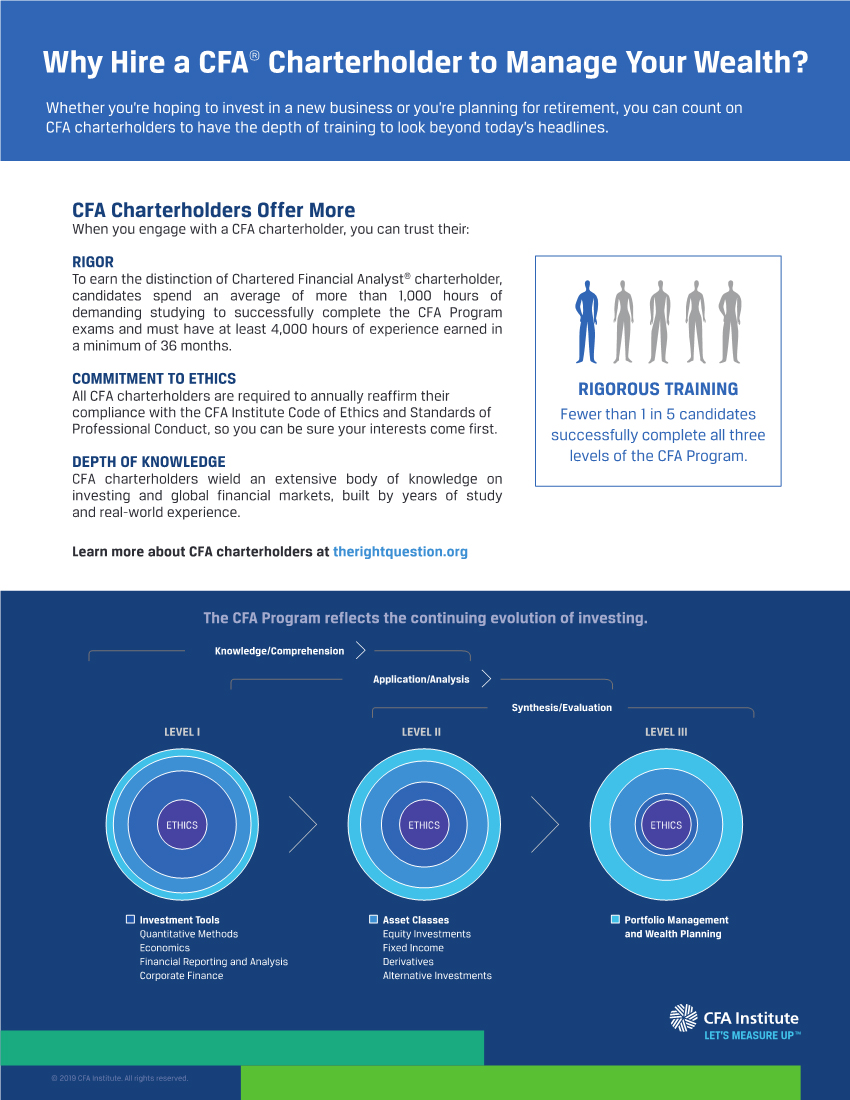

- Check Credentials: Look for advisors with recognized certifications, such as CFP (Certified Financial Planner).

- Ask for References: Don’t be afraid to ask for references from current or past clients.

- Interview Multiple Advisors: Just like you wouldn’t buy a car without a test drive, you shouldn’t hire an advisor without first meeting them.

- Trust Your Gut: If something feels off, it probably is. Go with the advisor who makes you feel comfortable and confident.

Choosing the right advisor is like finding the right pair of shoes—it’s all about fit. Take your time and find someone who truly understands your needs and goals.

Common Misconceptions

There are a few common misconceptions about allied integrated wealth financial advisors that we need to clear up:

- They’re Only for the Wealthy: Not true! These advisors can help anyone looking to improve their financial situation.

- They’re Just Salespeople: While some advisors may sell financial products, the best ones focus on providing sound advice and strategies.

- They Guarantee Returns: No advisor can guarantee returns, but they can help you make informed decisions to maximize your chances of success.

Don’t let these misconceptions hold you back from getting the help you need. A good advisor is worth their weight in gold.

Case Studies and Success Stories

Let’s look at a couple of real-life examples to see how allied integrated wealth financial advisors have helped others:

Case Study 1: John and Jane were struggling to save for their children’s college education while also planning for their own retirement. An allied integrated wealth financial advisor helped them reallocate their investments, increase their retirement contributions, and set up a 529 plan for their kids. Within a few years, they were on track to meet both goals.

Case Study 2: Sarah was nearing retirement and worried about outliving her savings. Her advisor helped her create a sustainable withdrawal plan, optimize her Social Security benefits, and even reduce her tax liabilities. Now, Sarah can enjoy her retirement with confidence.

These stories aren’t just flukes; they’re examples of what’s possible when you have the right guidance.

Data and Statistics

According to a study by XYZ Financial Research, individuals who work with financial advisors tend to accumulate more wealth over time. The study found that those with advisors had an average net worth 2.5 times higher than those without. That’s a pretty compelling statistic, don’t you think?

Another study by ABC Wealth Management revealed that 85% of clients who worked with advisors felt more confident about their financial future. That’s a testament to the value these advisors bring to the table.

Future Trends in Financial Advisory

So, what’s on the horizon for the world of financial advisory? A few trends to watch:

- Technology Integration: Expect to see more advisors using AI and machine learning to enhance their services.

- Sustainability Focus: More clients are interested in socially responsible investing, and advisors are adapting to meet this demand.

- Remote Services: The pandemic has accelerated the shift towards virtual meetings and online platforms.

These trends are shaping the future of financial advisory, and allied integrated wealth financial advisors are at the forefront of this evolution.

Final Thoughts

So, there you have it—a comprehensive look at allied integrated wealth financial advisors. Whether you’re just starting out or looking to take your financial game to the next level, these advisors can be invaluable partners in your journey. They offer expertise, personalized service, and peace of mind—all things that are hard to put a price tag on.

So, what’s your next move? If you’re ready to take control of your financial future, consider reaching out to an allied integrated wealth financial advisor. And hey, if you found this article helpful, don’t forget to share it with your friends and family. After all, good financial advice is worth spreading around.

Table of Contents:

Unlocking the Secrets of Allied Integrated Wealth Financial Advisor

What Exactly is Allied Integrated Wealth Financial Advisor?

Why Choose Allied Integrated Wealth Financial Advisor?

Key Services Offered by Allied Integrated Wealth Financial Advisors

How Allied Integrated Wealth Financial Advisors Work

Benefits of Working with Allied Integrated Wealth Financial Advisors

Costs and Fees

Choosing the Right Allied Integrated Wealth Financial Advisor

Common Misconceptions

Case Studies and Success Stories

Data and Statistics

Future Trends in Financial Advisory

Final Thoughts